Calpensions

CalPERS, CalSTRS and other government pensions

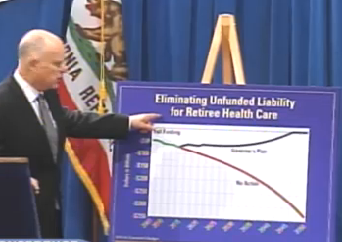

Brown plan to eliminate retiree health care debt

Gov. Brown wants state workers to begin paying half the cost of their future

retiree health care — a big change for workers making no payments for coverage

that can pay 100 percent of the premium for a retiree and 90 percent for their

dependents.

The governor also wants state workers to be given the option of a lower-cost

health insurance plan with higher deductibles. The state would contribute to a

tax-deferred savings account to help cover out-of-pocket costs not covered by

the plan.

More funding and lower premium costs are key parts of a plan to eliminate a

growing debt or gunfunded liabilityh for state worker retiree health care, now

estimated to be $72 billion over the next 30 years.

As Brown proposed a new

state budget last week, he pointed to a chart showing retiree health

care debt at a crossroads. If no action is taken, the debt by 2047-48 grows to

$300 billion. Under his plan, the debt by 2044-45 drops to zero.

gSo these are our promises,h he said, gand if we donft take any action you

are looking at hundreds of billions of dollars that we owe. And thatfs why I am

going to negotiate during our upcoming collective bargaining talks for the best

deal I can get for the workers and the taxpayers.h

State worker retiree health care is one of the fastest-growing costs in the

state budget. Next fiscal year its cost is $1.9 billion (1.6 percent of the

general fund), four times more than paid 15 years ago, $458 million (0.6 percent

of the general fund).

Brownfs plan would save taxpayers money by switching from gpay-as-you-goh

funding, which only pays the health insurance premiums each year, to

pension-like gprefundingh that invests additional money to earn interest.

Prefunding is widely urged as a way to cut long-term costs. The No. 1

recommendation of a governorfs public employee retirement

commission in 2008 was prefunding retiree health care.

The California Public Employees Retirement System expects investments to pay

two-thirds of total pension costs. The governorfs retiree health care plan is

expected to save nearly $200 billion over the next 50 years.

When fully phased in, Brownfs plan is estimated to cost the state $600

million a year in addition to the payment of premiums. The amount is half of the

gnormalh cost of future retiree health care earned by active workers during a

year, excluding debt from previous years.

State workers would contribute the other half of the normal cost, bringing

the total to $1.2 billion. With $1.9 billion for premiums, the total is still

well short of the $5 billion a state controllerfs report last month said is

needed for full funding.

Brownfs finance department said its cost estimates were developed with the

same actuaries used by the controller, but a different scenario. Though not

included in the estimates, California State University also is expected to

prefund retiree health care.

In an annual gfiscal outlookh last November, nonpartisan Legislative Analyst

Mac Taylor urged the Legislature to consider using the new Proposition 2 debt

payment fund to pay state worker retiree health care debt.

Brownfs proposal to have workers help pay for retiree health care follows

some large cities, such as San Jose and San Francisco, and his earlier

experience with the Legislature.

The governorfs first retiree health care proposal, part of a 12-point

pension reform, was dropped from the final version of the pension reform, AB 340

in 2012. An Assembly analysis said unions have gshown a willingness to bargain

over the issue.h

The California Highway Patrol, giving up pay raises for several years,

contributes 3.9 percent of pay to the state retiree health care investment fund

with a state match of 2 percent of pay. Physicians, dentists and podiatrists

(bargaining unit 12) and craft and maintenance (bargaining unit 16) contribute

0.5 percent of pay with no state match.

The governorfs proposal last week does not say how much of a bite from state

worker paychecks will be needed to yield a total of $600 million, half of the

retiree health care normal cost.

Brownfs first proposal in the 12-point pension reform did not include

prefunding state worker retiree health care. But the new plan last week has all

three of the retiree health care proposals that were in the first plan.

Ten years of service is needed to be eligible for retiree health care,

beginning at 50 percent coverage and increasing to 100 percent after 20 years of

service. For new hires, the plan pushes back the thresholds for new hires to 15

and 25 years.

The state pays more of the health care premium for retirees (100 percent

retirees, 90 percent dependents) than for active workers (80 to 85 percent

workers, 80 percent dependents). For new hires, the plan prevents a higher

subsidy in retirement than received on the job.

CalPERS is asked to gincrease efforts to ensureh seniors eligible for

Medicare are switching to lower-cost supplemental plans. For family members, the

plan calls for eligibility monitoring, some lower-cost coverage, and surcharges

if covered at work.

President Obamafs health care act imposes a gCadillac taxh on full-coverage

gplatinumh health plans in 2018, a move to control costs by encouraging

employers to move toward plans with higher deductibles and more out-of-pocket

expenses.

Brownfs plan directs CalPERS to offer workers the option of a

high-deductible health plan. The state would contribute to the tax-deferred

Health Savings Account of employees who choose the option to gdefray higher

out-of-pocket expenses.h

Itfs not clear whether state payments for retiree health insurance, which

are based on the average of the four highest-enrolled health plans, would be

reduced if large numbers of active workers, whose premiums doubled in the last

10 years, opt for lower-cost plans.

In bargaining, a standard response to a proposed cut is to ask for an

offsetting increase. When the largest state worker union agreed to an increase

in employee pension contributions in 2010, the agreement included a pay raise in

following years.

Brownfs plan presumably benefits state workers by making their retiree

health care more secure. Costs are said to be growing at an gunsustainable

pace.h Worker contributions might strengthen the legal argument that retiree

health care is a gvested righth protected by contract law.

Meanwhile, the contrast with other workers grows. The number of large

private firms (200 or more employees) offering any level of retiree health care

dropped from 66 percent in 1988 to 28 percent in 2013, a Kaiser

report said. Many California teachers have no employer retiree health

care.

For state workers who retire early, retiree health care can be a

major benefit. With at least five years of service, state workers are eligible

to retire at age 50, age 52 if hired after Brownfs pension reform took effect on

Jan. 1, 2013.

gThe plan preserves retiree health benefits when the private sector is

scaling back, maintains health plans, and continues the statefs substantial

support for employee health care,h the governorfs budget summary said last

week.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three

decades, most recently for the San Diego Union-Tribune. More stories are at

Calpensions.com. Posted 12 Jan 14